In today’s financial landscape, many individuals opt for joint accounts, particularly joint checking accounts, to manage shared finances effectively. This article delves into the core aspects of joint account rights and responsibilities, demystifying sharing a financial account with someone else. Individuals can ensure responsible and harmonious joint financial management by understanding the intricacies of these rights and responsibilities.

Equal Access and Ownership

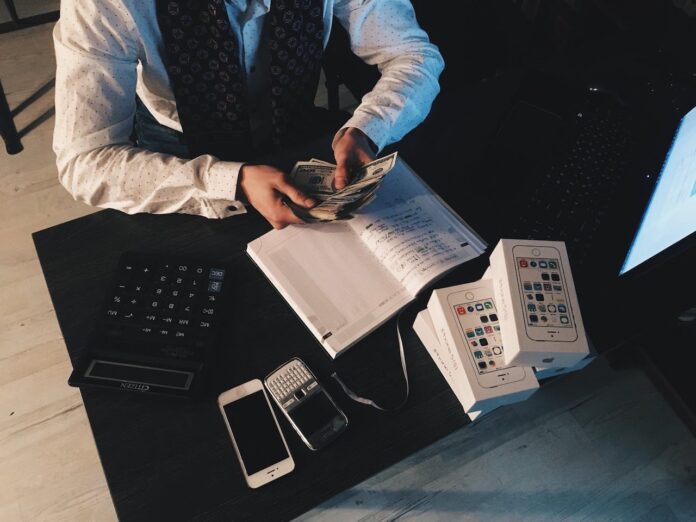

One of the fundamental aspects of a joint checking account is that all account holders share equal ownership. This signifies that each individual on the account has full access to the funds, and any account holder can conduct transactions independently. This convenience can be particularly advantageous when managing shared expenses, as it provides an efficient way to cover bills and financial responsibilities.

Deposits and Withdrawals

The flexibility to make deposits and withdrawals is a shared responsibility in joint accounts. Account holders can deposit funds into the joint checking account, and any account holder can withdraw from it. This equal access is aimed at simplifying day-to-day financial transactions and shared expenses. However, it also demands high trust and effective communication between account holders to ensure that the account functions smoothly.

Overdrafts and Liabilities

Joint account holders should know the shared responsibility regarding liabilities and potential overdrafts. If the joint checking account experiences an overdraft due to one account holder’s actions, all individuals on the account share the responsibility for repaying the overdraft amount. Creditors also possess the right to collect outstanding debts from any of the account holders, which could impact everyone’s credit history.

Understanding these financial obligations and liabilities is crucial for responsible joint financial management. Open communication and trust between joint account holders play a significant role in preventing potential issues related to overdrafts and liabilities.

Online Banking and Security

Online banking is pivotal in managing joint accounts in today’s digital age. While all account holders have access to the account online, it’s crucial to maintain security. Each individual should have a unique username and password for online access. These login credentials must be confidential and not shared with other joint account holders to safeguard financial security.

Privacy and Confidentiality

SoFi states, “A joint bank account gives designated account holders complete and unlimited access to the account. Account holders can contribute, withdraw, and transfer money to and from their shared checking and savings accounts.”

Though joint account holders share ownership and access, certain financial information is still considered confidential and individual. Personal identification information, like Social Security numbers and account passwords, should remain private and should not be disclosed to other joint account holders. Additionally, when dealing with online banking and account management, account holders should exercise caution to protect sensitive financial details.

Joint accounts can be an excellent tool for effective financial management among couples, family members, or business partners. However, understanding the rights and responsibilities associated with these accounts is pivotal. By recognizing the aspects of equal access, shared deposits and withdrawals, liabilities, security, and privacy, account holders can ensure that their joint checking account functions smoothly and harmoniously. Open communication and a commitment to responsible financial behavior are the cornerstones of a successful joint financial management experience.

In essence, while joint checking accounts offer numerous advantages, account holders need to approach them with a clear understanding of these accounts’ shared and individual aspects. By doing so, they can build a solid foundation for successful, responsible, and secure joint financial management.